KuCoin Borrow: Accessing Liquidity for Personal and Business Loans

Accessing Liquidity for Personal and Business Loans with KuCoin Borrow

What is KuCoin Borrow?

KuCoin Borrow is an innovative platform that allows users to access liquidity for personal and business loans. Whether you need funds for a personal emergency or want to expand your business operations, KuCoin Borrow provides a hassle-free solution.

How does KuCoin Borrow work?

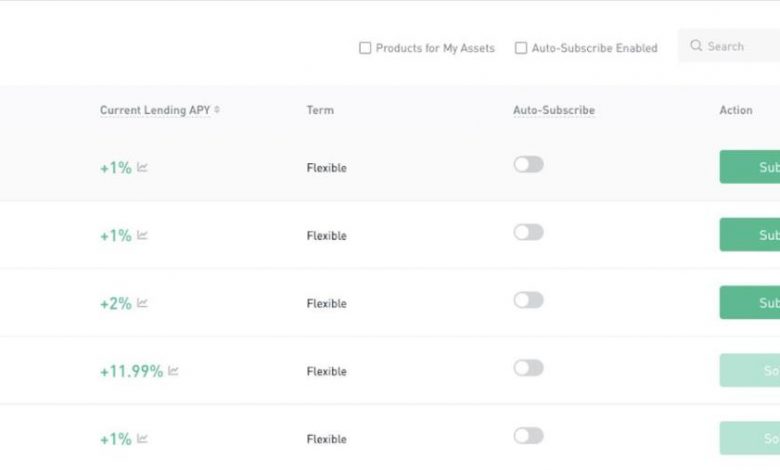

With KuCoin Borrow, you can use your digital assets as collateral to secure a loan. The platform supports various cryptocurrencies, including Bitcoin, Ethereum, and more. Once you deposit your assets as collateral, you can borrow funds instantly.

Here’s how it works:

- Deposit: Choose the cryptocurrency you want to use as collateral and deposit it into your KuCoin Borrow account.

- Loan Amount: Select the desired loan amount and the currency you want to borrow.

- Terms: Set the loan duration and interest rate that suits your needs.

- Receive Funds: Upon approval, the borrowed funds will be credited to your KuCoin account.

Advantages of KuCoin Borrow

KuCoin Borrow offers several advantages over traditional lending platforms:

- Instant Approval: Unlike traditional loan applications, KuCoin Borrow provides instant approval, allowing you to access funds quickly.

- No Credit Checks: With KuCoin Borrow, there are no credit checks required, making it accessible to a wider range of users.

- Competitive Interest Rates: The platform offers competitive interest rates, ensuring that you can borrow funds at affordable rates.

- Flexible Loan Terms: You have the freedom to choose the loan duration and interest rate that best suits your financial goals.

Frequently Asked Questions (FAQs)

1. Is KuCoin Borrow safe?

Yes, KuCoin Borrow has implemented industry-standard security measures to ensure the safety of your funds and personal information. Your collateral is stored in cold wallets, which are offline and not accessible by hackers.

2. How long does it take to receive borrowed funds?

Once your loan application is approved, the funds are usually credited to your KuCoin account instantly. However, it may take a short processing time in some cases.

3. Can I repay my loan early?

Yes, you have the option to repay your loan before the agreed-upon loan duration. By repaying early, you can save on interest charges.

4. What happens if I default on my loan?

If you fail to repay your loan within the agreed-upon period, your collateral will be liquidated to cover the outstanding amount. It is essential to manage your loan responsibly to avoid any negative consequences.

Conclusion

KuCoin Borrow offers a convenient and efficient way to access liquidity for personal and business loans. With its instant approval process, competitive interest rates, and flexible loan terms, it is a reliable platform for individuals and businesses in need of quick funds.

Start leveraging your digital assets with KuCoin Borrow today and unlock the liquidity you need to achieve your financial goals.